With respect to the team, you will see numerous cycles away from airdrops jupiterswap you start with an excellent 1B JUP token airdrop to the basic round of airdrops scheduled for January 2024. Jupiter states you to the decentralized restriction purchase element works with the fresh exact same overall performance as the central limit sales. The sole distinction ’s the lack of business manufacturers, an order guide, and you will a central manage system.

They says that the system is actually costs-effective, encourages an informed usage of protocols to the network, and you can promotes the brand new adoption of the Solana blockchain to own decentralized financing. On the launchpad, Jupiter expectations to support the new projects to help you victory and covers the buyers out of hype, fomo and you can rugs. Jupiter is a good DEX aggregator to the Solana that is designed to help you help users get the ”lowest price” in one place. In addition, it have advanced features to switch entry to, such restrict requests and you may buck-prices averaging. As the airdrop season efficiency, uncover what the fresh style within the airdrop costs are & once you to sell airdrop tokens. Which have told you it, it’s still vital that you believe that when you are these features is actually designed for convenience-of-play with, pages still have to comprehend the basis of any operation.

A residential area coin to give back and immortalize WEN culture.WEN is actually for town created away from @weremeow’s fractionalized poem NFT. EIP-4844 (proto-danksharding), an update to your Ethereum process, lies the fresh groundwork to have danksharding which can be step one to your all the way down gas charge. Greatest Solana ideas to watch were DEXs, credit, and liquid staking protocols, in addition to common NFT choices such Upset Lads. You can examine your allocation away from JUP during the Jupiter’s official airdrop checker.

- With told you that it, it is still crucial that you believe that when you are these features is actually available for convenience-of-play with, users still need to comprehend the basis of any process.

- We have been playing with a customized unmarried-sided Meteora DLMM pool while the a manuscript system so you can bootstrap early liquidity.

- In times out of network obstruction, such airdrop says, you can try increasing your priority charge.

- Dollar-Costs Averaging (DCA) are a well-known method for spot acquisition of property.

- Wormhole are a keen inter-circle chatting protocol that enables advanced communication between blockchain networks.

You might also need to help you relax your rate targets and you will slippage endurance to truly get your deals as a result of. Bear in mind that your own slippage setting and you may maximum/minute rate settings were there to guard you, which should be inside your threshold. The newest Jupiter team provides common agreements for the launch of JUP, the new indigenous token of your platform. Thru a post for the X, the new Jupiter group shared that the full supply of JUP tokens might possibly be put at the ten billion. Wormhole are an inter-network chatting protocol which allows complex interaction anywhere between blockchain systems. At the time of creating, Jupiter’s bridge running on Wormhole helps the brand new bridging from possessions ranging from the newest Ethereum and you can Solana blockchains.

Jupiter has a decentralized perpetuals trading system where pages takes enough time or short ranking having around 100x leverage. Liquidity business to your derivative change program lock-up the assets in the perpetuals container and you may earn as the traders use these financing because of their positions. The newest continuous vault currently supporting five property; WBTC, USDT, USDC, SOL, and you may ETH.

The theory would be to help the trader’s likelihood of capturing some other height points (for transformation) and you will downs (for sale) as opposed to trade all at once and an individual cost. On the Solana, Jupiter also offers pages a single-stop attraction one lets pages have the “lowest price” for their change in one place. Since the an aggregator, it will access cost and exchangeability of all of the DEXs connected to it. According to the statement post, LFG usually act as a deck you to definitely books the new ideas to help you the market.

Based on presiding requirements, the transaction was routed thanks to multiple liquidity swimming pools. For each version is called a jump, and you can a single exchange transaction could go as a result of 3 Hops. Jupiter claims that the system allows traders to help you easily use the most powerful and you will funding-efficient studio for each exchange.

Jupiter says one to the aggregator links to around 20 DEXs and you may AMMs to your Solana network. Dollar-Prices Averaging (DCA) is actually a popular method for location acquisition of possessions. Here, traders split up its transactions to sell otherwise buy a secured asset over go out at the other attacks.

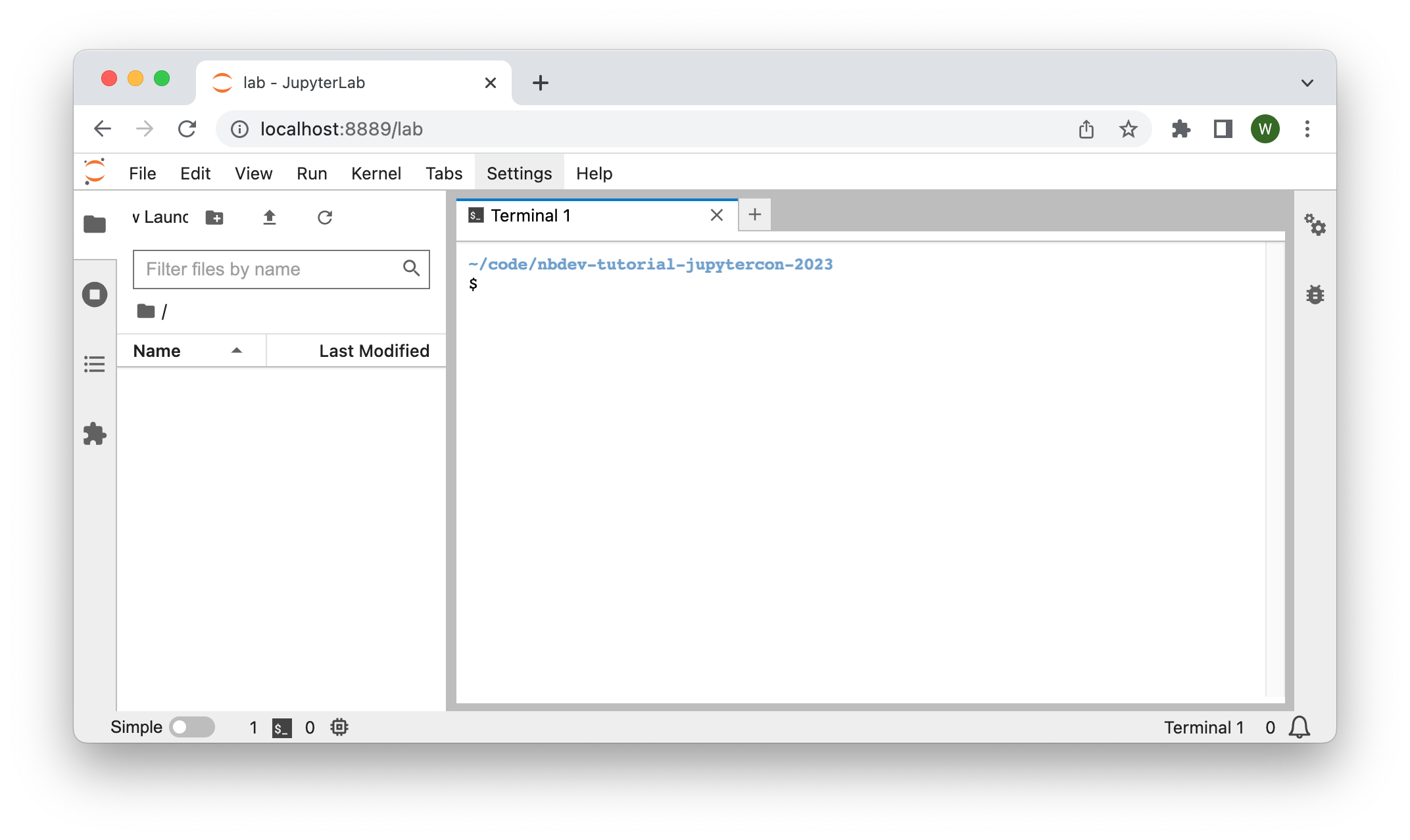

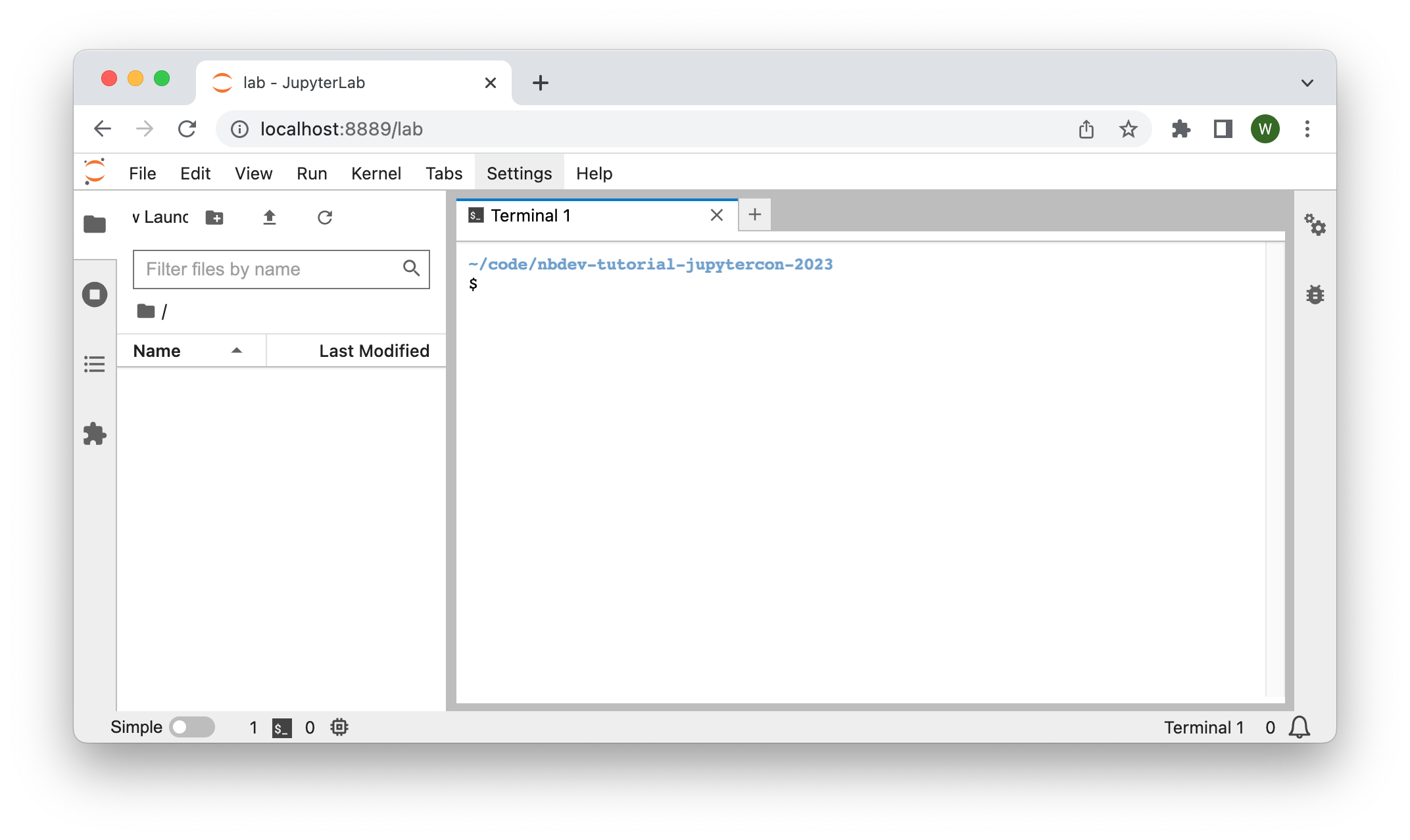

”No study” after sending tx Jupiter Change Python: jupiterswap

Using this type of investigation, Jupiter next picks a path on the customer’s deal. On the Jupiter, whenever a person urban centers a limit buy, the new method retains the transaction as well as specifics of put variables (selling/to purchase speed and numbers) regarding the restriction purchase method. The newest process next get rates away from offered decentralized transfers and you can inspections changes in these costs. When the market value are at the purpose place because of the trader, it motions to perform the newest change. If the for the-strings liquidity is actually shortage of to your acquisition proportions, it does the fresh positions inside the smaller servings through to the buy are completed. Limit orders allow buyers to arrange a trade you to merely does when the stated requirements try fulfilled.

Solana computers several decentralized transfers that offer direct resource exchanges playing with exchangeability pools as well as the automated field creator (AMM). However, exchangeability conditions over the additional resource pairs in these exchanges differ. Because of this, costs of the identical advantage you may disagree notably, and the liquidity requirements might trigger high slippage for the some of these transfers. Jupiter, a DEX aggregator to the Solana, was created to help pages get the best prices in one set, and will be offering pages has such as restriction sales and you may buck-prices averaging (DCA). Jupiter is actually a DEX aggregator; they connects to many decentralized exchanges to include pages which have a keen communication path to the exchanges from a single user interface. From this partnership, Jupiter could possibly see center investigation such liquidity conditions round the advantage pairs, prices away from property and you will charges charged from the liquidity team, and a lot more.

The best swap aggregator & structure to possess Solana – guiding best price, token choices and you can UX for everyone profiles and you can devs. You could potentially allege WEN from this webpage, otherwise trade it having fun with Change, DCA and you may Limitation Orders. You may also go to almost every other AMMs for example Meteora.ag to incorporate exchangeability for WEN and you can earn trade charges.Sign up Ovols Dissension. We’re using a custom made single-sided Meteora DLMM pool while the a novel device in order to bootstrap early liquidity. It’s got a minimal inital speed to possess fast rate discovery and you can to attract instant USDC liquidity to own papers paws to help you eliminate.

What’s Jupiter as well as how It’s Operating DeFi Adoption on the Solana

To execute the order reduced, you could potentially put a high priority, even though this will likely cause higher costs. On the January 23, 2024, the new pseudonym trailing the development of Jupiter established the newest discharge of LFG, a great launchpad to possess Solana ideas through a post to the X. There is an OG Bonus, to possess profiles you to definitely transacted at the least ten for the Jupiter before stop from March 2022. Today, let’s take a look at any of these state-of-the-art utilities and you will what they offer Jupiter users. Access probably the most liquidity, lowest slippage and best exchange rates across Binance Smart Chain and Polygon. Concern charges was higher in the release period, and really should settle down quickly after discharge.

Allege WEN

Mouse click Connect Handbag from the website landing page for connecting the purse for the program.

After going for their route, users are rerouted on the common connection to complete its transactions. Bridging institution backed by Jupiter are Mayan Financing and you can Debridge. Considering investigation on the circle’s explorer, Jupiter is one of Solana blockchain’s really made use of software. Jupiter states techniques an average of 350 million worth of crypto possessions positions every day away from over 100,100 book wallets.

This really is easier for including networks since they work with your order guide program, and that spends track of trade requests for an resource couple. For decentralized transfers, this is more tricky because of the characteristics from the new AMM and you will liquidity pools. An improvement on the endeavor states you to definitely tenpercent of the overall source of this type of tokens might possibly be used in very first liquidity supply for the JUP token. Other team have would be separated ranging from a ‘strategic reserve’ as well as the party itself. The new fiftypercent arranged for the area will be committed to community reward software along with an enthusiastic airdrop to have very early followers and you will neighborhood has. During the launch, 15-20percent of the full have is certainly going on the movement, which have 10percent on the very first up coming airdrop and you may 5percent to own liqudity supply.

People say that LFG launchpad would be solely backed by the city and does not have any added bonus specifications otherwise rates discovery program. It is said that Jupiter DAO often oversee the newest key elements of one’s launchpad, including the recognition away from projects in order to discharge utilizing the business thru a community choose. In times from network congestion, for example airdrop says, you can look at increasing your concern fees.

Interacting with the new Jupiter program individually otherwise through-other associated networks is the primary degree requirements to your JUP airdrop. The team suggestions you to definitely token allotment for every bag will be weighed depending on the regularity from communications and you may full regularity transacted. However, Jupiter’s utility isn’t limited to direct investment exchanges due to numerous transfers. The working platform provides a number of other state-of-the-art tools to change the consumer feel. Jupiter was launched inside 2021 which can be serious about carrying out a good program to own DeFi enthusiasts to the Solana community.

Although this post will bring a summary and you can inclusion to help you Jupiter, there are other has, such perpetuals, which are not safeguarded right here. This article is composed to own informative objectives simply and cannot be studied while the financial advice. Constantly analysis own lookup to the one method prior to signing permissions together with your purse. 20percent of one’s airdrop allotment will be marketed equally between all of the qualifying purses. The fresh Jupiter people also has mutual more information out of a keen airdrop system to the venture’s neighborhood. The fresh JUP token tokenomics boasts a good 40percent set-aside for area award applications.

Moreover it provides early backstop liquidity the team usually do not withdraw. Jupiter is the vital thing liquidity aggregator to own Solana, providing the widest directory of tokens and best station breakthrough anywhere between any token few. The brand new WEN token ’s the basic poem token released using Jupiter’s the brand new LFG launchpad, because of the Ovols team. Check out the investment team’s announcement regarding your JUP token airdrop. Town have a tendency to leader the fresh issues of your own enterprise through the DAO. For more information, check out the enterprise team’s offres to your JUP token.